retroactive capital gains tax meaning

An excess of capital losses over capital gains in a tax year may be carried back three years and carried forward five years to be. Based on the terms of the securities and representations provided by us our counsel is of the opinion that the securities should not be treated as transactions that have a delta of one.

Tax On Real Estate Sales In Canada Madan Cpa

Is an externally managed business development company that seeks to generate current income and capital appreciation by investing in debt and income generating equity.

. 41013 Certain Technical Issues 410131 Section Overview 410132 Accumulated Earnings Tax IRC 53 Skip to main content. To an arms-length person. An income tax is a tax imposed on individuals or entities taxpayers in respect of the income or profits earned by them commonly called taxable income.

A taxpayers business investment loss is basically a capital loss from a disposition of shares in or a debt owing to the taxpayer by a small business corporation SBC where the disposition is. The Notes will be redeemable in whole or in part at any time or from time to time at the option of Prospect Capital Corporation on or after February 15 2023 at a redemption price of 1000 per Note plus accrued and unpaid interest payments otherwise payable for the then-current semi-annual interest period accrued to but excluding the date fixed for redemption and. Income tax generally is computed as the product of a tax rate times the taxable income.

You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. 56000 of ordinary income 44000 from current year plus 12000 from prior years and 44000 of capital gains. However the country where you are resident for tax purposes can usually tax your total worldwide income earned or unearned.

Repeal of Corporate Capital Gains Treatment - Sets the rate of tax for capital gains realized by a corporation at a maximum of 34 percent the regular corporate rate. This includes wages pensions benefits income from property or from any other sources or capital gains from sales of property from all countries worldwide. D Capital Gains from Sale of Real Property.

Domestic income earned by foreign artists athletes license grantors and directors within the meaning of Section 49 Income Tax Act EStG is subject to limited tax liabilityThis income is taxed using a special procedure the tax withholding procedure defined in Section 50a EStG. A one-to-one ratio of reduced tax revenue to induced investment is thought to represent a meaningful effectiveness threshold based on the assumptions that. For corporations capital losses are allowed only as an offset to capital gains.

In the seminal case in this area the Tax Court held thatthe taxpayer trafficked in medical. - The provisions of Section 39B notwithstanding a final tax of six percent 6 based on the gross selling price or current fair market value as determined in accordance with Section 6E of this Code whichever is higher is hereby imposed upon capital gains presumed to have been realized from the sale exchange. The 9000 excise tax is allocated to corpus and does not reduce the amount in any of the categories of income under paragraph d1 of.

The book account may have been reduced by the transfers to capital or other accounts in the form of stock dividends or reserves. SP 500 dividend yield 12 month dividend per sharepriceYields following June 2022 including the current yield are estimated based on 12 month dividends through June 2022 as reported by SP. 1 For all periods presented in this press release common share and per common share amounts have been adjusted on a retroactive basis to reflect the Companys one-for-ten reverse stock split.

Capital or inventory account and recovered through depreciation or amortization deductions as a cost of sales or in any other manner. One-half of this loss is an allowable business investment loss ABIL. We use our capital coupled with borrowed funds to invest primarily in real estate related investments earning the spread between the yield on our assets and the cost of our borrowing and hedging activities.

We are an internally-managed Maryland corporation founded in 1997 that has elected to be taxed as a REIT for US. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. Foreign artists athletes license grantors and directors payees can claim relief from German.

Unlike ordinary allowable capital. Federal income tax purposes. Standard Poors for current SP 500 Dividend Yield.

Or business as referred to in IRC 482. The Tax Court has tried a few cases involving taxpayers that sell medical marijuana. Robert Shiller and his book Irrational Exuberance for historic SP 500 Dividend Yields.

- 1 In General. The character of the 100000 distribution to the noncharitable beneficiary is as follows. One to which subsection 501 applies.

Makes such rate effective for gain properly taken into account under the taxpayers method of accounting on or after January 1 1987 without regard to whether the. 100-445 at 104 1988. The Service argued that the taxpayer was.

The Funds will not be subject to the 4 Federal excise tax imposed on regulated investment companies that do not distribute substantially all of their income and gains each calendar year so long. Great Elm Capital Corp. 1 a 1 increase in investment in response to a 1 tax credit suggests that the tax credit may be more cost-effective than a well-structured direct RD subsidy and 2 due to the potential.

Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing. Gains or losses on the sale or exchange of capital assets held for 12 months or less are treated as short-term capital gains or losses.

Biden Retroactively Doubles Capital Gain Tax But Keeps 10m Benefit

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Insights Into Editorial Why Is Retrospective Tax Being Scrapped Insightsias

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

2022 Federal Budget Details Continued Spending With Limited Tax Measures Moodys Private Client

Explained What Is Retrospective Tax And Why The Centre Buried It Deccan Herald

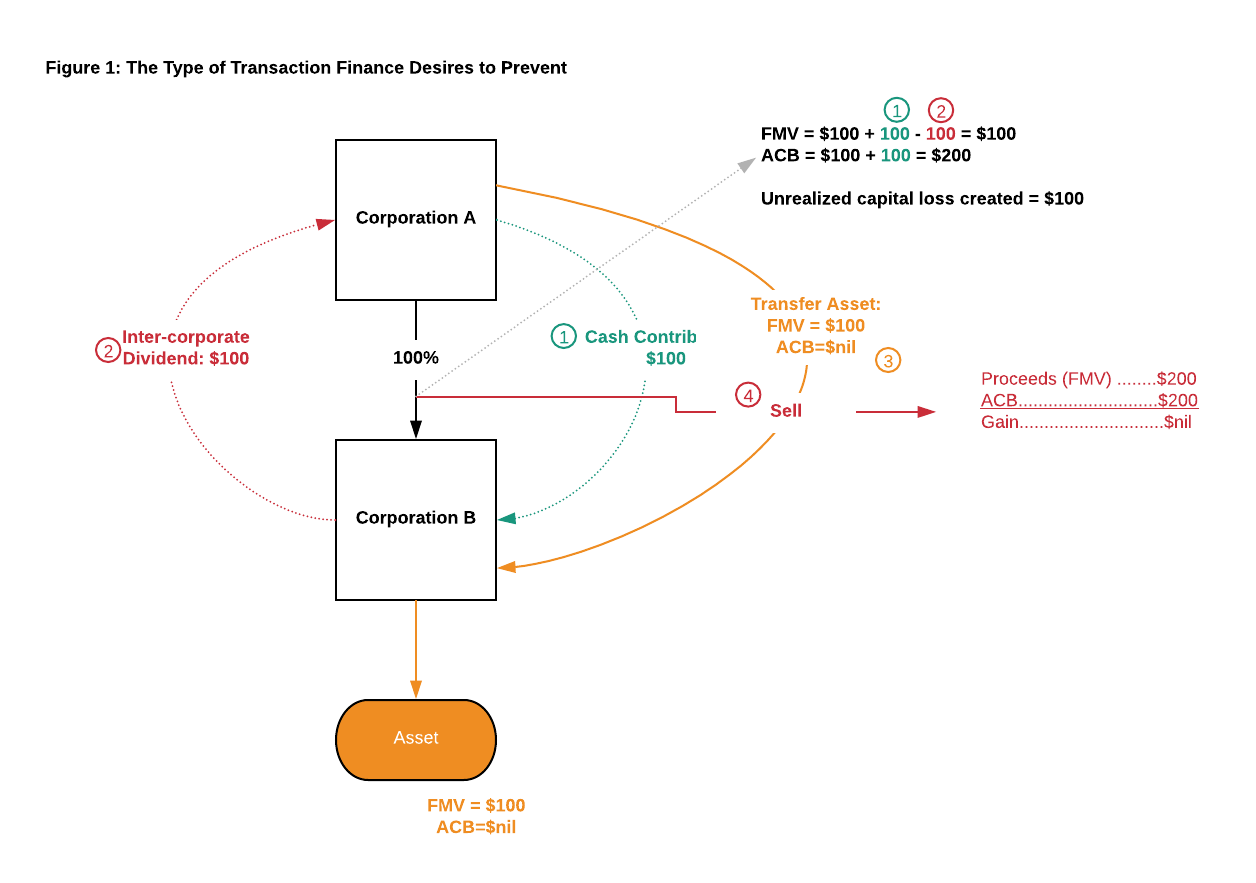

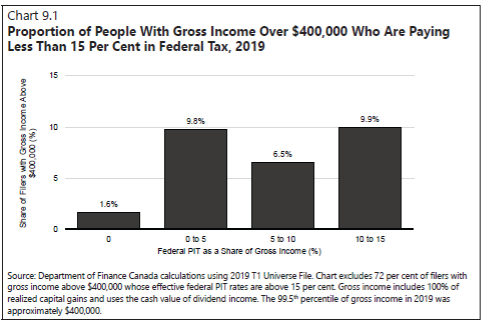

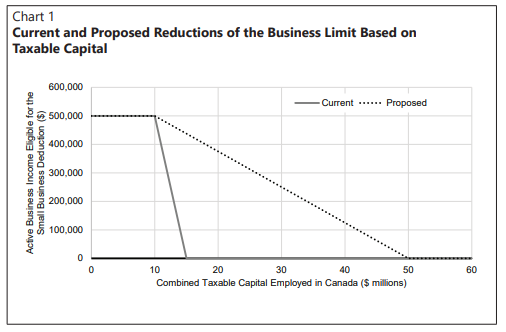

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Corporate Mistake Bc Supreme Court Declines To Permit Retroactive Tax Planning Alexander Holburn Beaudin Lang Llp

2022 Federal Budget Details Continued Spending With Limited Tax Measures Moodys Private Client

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

Smythe Llp Possible Changes Coming To Tax On Capital Gains In Canada

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc